How We Delivered 2,473 Conversions to a Banking Client in 6 Days at a ~$9 CPL

The SBA’s recent Paycheck Protection Program (PPP) sent the nation scrambling; small business owners rushed to accumulate the necessary documentation, and banks raced to accept their applications. Competition amongst financial institutions was steep.

Banks had a matter of days — if not hours — to create landing pages, build ad campaigns, implement tracking mechanisms, and edge out their competitors for PPP applications. As a result, a regional banking institution tasked Majux Marketing with the following:

- Capture as many PPP applicants as possible with $20,000 in budget via Google Ads

- Prioritize five states

- Pause the ads when the SBA’s budget was used up, and restart once funding continued

- Track conversion activity on the client’s website

The following outlines our time frame, our management activity, and our results.

Time To Launch +/- 24 Hours

From the time we received the call from our banking client, we had 24 hours to launch the campaign — a delayed launch would mean missing out on thousands of highly motivated clicks.

Step 1: Creating The Ads

We started by drafting 10 different text ads. The emphasis was on highly diversified ad copy; we needed to rely on rapid A/B testing to find the most resonant message within the first 24 hours. Our pro tip: we submitted the ads for editorial review in Google Ads while the client was obtaining final approval on the copy. That allowed us to launch approved ads as soon as the client gave them the green light. If we had needed edits to some of the ads, we would still have a handful of ads to launch with immediately.

Step 2: Landing Page Build

We didn’t have much time to build out a landing page, so we used wireframes from landing pages for banking clients that had previously been successful. We worked with the client to implement web copy, made sure everything passed legal review, and set up conversion tracking via Google Tag Manager. Lastly, we make sure all of those conversion actions were imported to Google Ads for easy analysis.

Step 3: Keyword Targeting

This campaign was tricky – we were dealing with brand new terminology/subject matter that Google did not have data on yet. As a result, we carefully built a long list of broad match modified keywords to capture all possible colloquialisms and permutations of our target phrases. We also started off with a well-developed negative keyword list.

Step 4: Building Out the Campaign

We built a campaign for each geographic region — this allowed us to manage and adjust budget allocation closely. We then set generous CPC bids to make sure we would capture enough volume (those bids could always be slashed if we started seeing enough volume).

We also built retargeting audiences based on landing page click activity, and we hooked those up to the Google Ads remarketing campaign before we launched.

The Optimization Process

Over-optimization with only a short data-gathering period is usually a mistake, but two factors required us to make changes on a real-time basis:

- The sheer volume of this campaign

- The short amount of time we had to maximize results

Same-Day Optimization

Regarding that first point, we saw a tremendous amount of clicks as soon as the campaign went live. That filled up the search query report faster than usual, and we were able to start adding negative keywords within hours of the campaign launch. The high volume also set the stakes higher — if we didn’t catch an irrelevant search query early, it could drain hundreds of dollars from a campaign that was already limited by budget.

The campaign volume also allowed us to collect conversion data at a fast face. Given the real-time reporting capabilities of Google Analytics, we could see which ad groups and keywords were having the desired impact the same day that we launched the campaign.

Within six hours of setting the campaign live, we added negative keywords, adjusted bids on high-performing keywords, and re-allocated budget across our target geographies..

Optimization: Day 2

After the previous day’s conversion data had passed through, we were able to make larger optimizations to the ad campaign. We had built separate campaigns for each state we were targeting, so geographic optimization was easy — but we still found opportunities for bid adjustments within each state (the NYC region vs. Albany, for instance).

The second thing we optimized on Day 2 was our overall bidding strategy. The first day of data showed us that we were massively limited by budget. Our campaigns could have spent up to $20K on that first day alone. Since our client couldn’t raise their advertising budget to meet demand, we were able to slash our CPC bids by upwards of 50% without sacrificing volume — and this led to a tremendous improvement in CPL.

Thirdly, we acted on the results of our creative A/B testing. We paused underperforming creative and allocated more volume to our best ads.

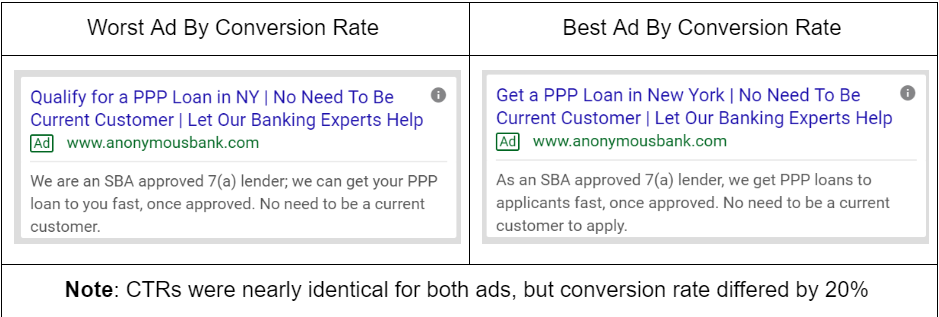

Our Top-Performing Vs. Worst-Performing Ad Copy

Since CTR ultimately doesn’t matter (why would we want unqualified clicks as long as we are maxing out our budget?) we ranked our ads by ultimate conversion rate.

The 20% difference in conversion rate between the two ads was fascinating, given the similarities in ad copy. That just goes to show the value of A/B testing for advertisers.

The Results

To sum it all up, here were the broad campaign metrics minus conversions:

- $19,548.78 in ad spend

- $2.39 avg. cpc

- 8,191 clicks

- Total days active: 6

Unfortunately, we were not able to track applicants all the way through to account completion (since there was a manual approval process in place). However, we were able to track which applicants 1) clicked through to the application, and 2) clicked the “consent” button to kick off the application. We also tracked phone calls and form submissions. Based on our feedback from the client, almost everyone who clicked through to the application ended up filling it out.

All told, we saw these conversion metrics:

- Last Click attribution model: 2,123.00 conversions ($9.21 CPL)

- Last Google Ads Click attribution model: 2,473.00 conversions ($7.90 CPL)

Interested in Similar Results?

While we certainly aren’t hoping for another pandemic-fueled advertising campaign anytime soon, we have a tremendous amount of experience running lead generation campaigns on Google Ads and Facebook for financial institutions. If you need to boost your checking account signups, savings account registrations, or anything else, please give us a call. We’re always happy to chat.