The AM Law 100 lists some of the most powerful global law firms in terms of gross revenue. Even the smallest firms on the list have annual revenues in the hundreds of millions of dollars. These firms have political clout, offices across the globe, and investment capital to spare…but what condition are their websites in? We examined the domains of the top six 2014 AM Law 100 members and found some interesting data. From a law firm SEO perspective, we won’t focus on website aesthetics, but hard numbers and other quantifiable data points.

Age of AM Law 100 Member Websites

Site age can be an important factor in how Google and other search engines view the overall trust of a domain. If the site has been around for several years, has accurate Whois info, and consistent domain registration, they’re in good position to rank well in search results other factors notwithstanding. As it turns out, the biggest law firms have sites that are decades old, with one exception:

- Freshfields Bruckhaus Deringer: Site Registered October 26, 1994

- Allen & Overy: Site Registered April 18, 1995

- Skadden: Site Registered October 27, 1995

- Linklaters: Site Registered September 23, 1996

- Baker & McKenzie: Site Registered January 15, 1999

- Norton Rose Fulbright: Site Registered October 17, 2012

* Oldest Site: Freshfields Bruckhaus Deringer

Norton Rose Fulbright, the firm with the youngest website (by nature of a merger in 2013), is third on the AM Law 100 list for 2014 with annual revenue exceeding $2.3 billion. Clearly, having a relatively new domain compared to others at the top isn’t hurting the firm’s cash flow. All of these site ages (withstanding Norton Rose) are in the similar tiers of site age. Let’s take a look at domain authority.

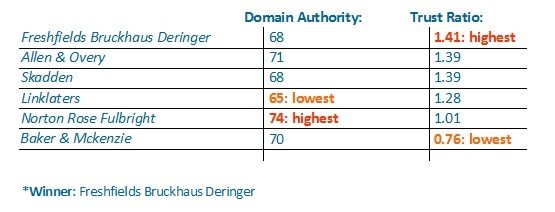

Domain Authority and Trust Ratio

With Page Rank dead for good (according to Google’s John Mueller) we’ll need newer metrics to gauge site health on the web. Domain Authority (Moz) and Trust Ratio (Majestic) can help us understand the strengths of each site, including its linking strategies and likely search rankings. Trust Ratio is particularly interesting because it can serve as a good indicator of whether a link from the site will help your own domain or hurt it. Check out how the top six firms stack up:

A Trust Ratio above 1.0 (Trust Flow/Citation Flow) is an indicator of a site with a strong backlink profile from trustworthy sources around the web. It appears that Baker & Mckenzie, the AM Law 100’s highest grossing firm in 2014, doesn’t have the best links pointing back to its domain. That could be the reason that a younger site, Norton Rose Fulbright, is beating it on both Domain Authority and Trust Ratio. What’s influencing these ratings? Time to head to the backlinks.

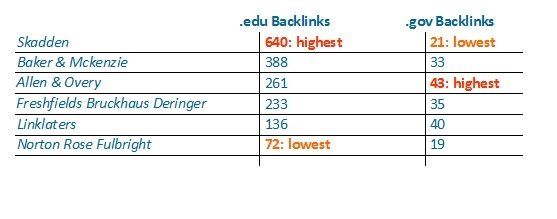

AM Law 100 Backlinks

The sheer number of backlinks flowing into these domains is massive. Total external do-follow links for the top six AM Law 100 in 2014 range from about 30,000 to a little under 90,000. Picking through the entire mountain would be insanely time consuming, so let’s focus on a couple areas that jump out in the data – education and governmental backlinks. These domain types (.gov and.edu) have traditionally high authority that convey rock solid trust. Any site would love a do-follow link from an.edu or a.gov. An Ahrefs crawl of these law firms shows a rich bounty of them:

The firm with the second-highest number of educational and governmental backlinks (Baker & McKenzie) also performed on the lower end of our Trust Ratio, while the leader in this category finished in the middle of the Trust Ratio pack. Why? In my estimation, there are two main reasons:

- Diluted Backlink Profile: These are law firms, not government agencies or accredited universities. Backlinks from.edu’s and.gov’s, while authoritative, can dilute your brand and make search engines reconsider the intent of a website. Google gets confused on how to categorize it, and overall trust can diminish. If there’s a point for diminishing returns, some of these firms appear to have reached it.

- Size Works Against Them: Websites that are decades old and accumulating tens of thousands of links are bound to have more than a few hundred bad apples hanging on in the link profile. A portion of these links could be from sites that no longer function, pages that 404, or (we hope not) are from toxic neighborhoods flagged by Google.

Customer Intent and Social Media

Every firm in the top six had one thing in common in that no contact form for potential clients exists on the homepage. Clearly, conversion, at least over the web, isn’t the intent of these sites, which appear geared to more telling visitors about the firm, how to get jobs at the firm, and news about industry-relevant matters. Firms with offices around the globe wouldn’t have much use for a single contact form anyway – too many moving parts, languages, and needs at play.

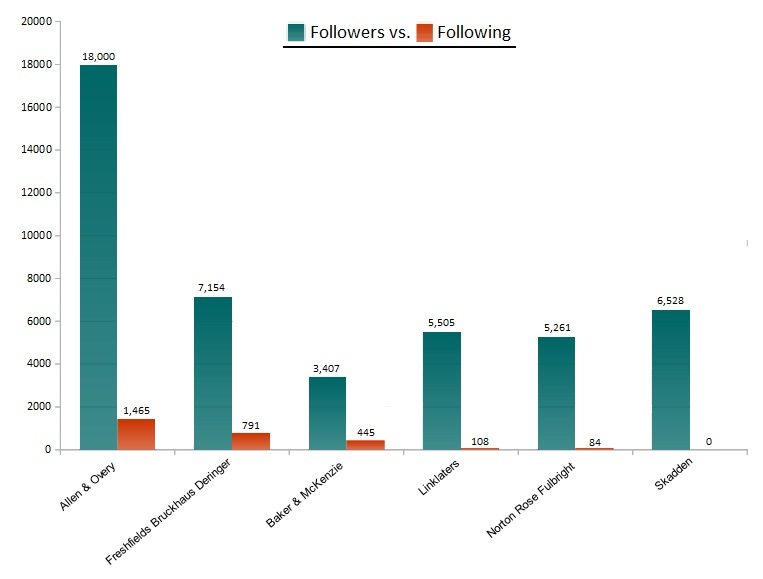

While contact forms were absent, every firm has their social media buttons in place. Each firm has a varying amount of social presence and ways to reach them. Only three firms (Skadden, Baker & McKenzie, and Norton Rose Fulbright) have Facebook pages. The Linklaters website alleges the firm to have a Facebook page, but the link is broken. A Google search for their Facebook brings up a myriad of results, with the most promising page not having any substantive activity since November, 2013. Everyone appears to have Twitter, so let’s check followers and activity:

Of course, some of the big firms are getting Twitter wrong. The goal isn’t to create a rotating billboard of firm accomplishments, but to achieve engagement with an audience. While it’s a smart strategy to have more followers than following, it doesn’t foster interaction when the feed is nothing but news related tweets and re-tweets of other content that clearly has a commercial bent. Why would anyone want to follow a company that shouts at them all day (Skadden), but appears interested in nothing else?

Site Construction and Content Management

Here’s the gritty technical stuff that gives us clues as to how engaged each firm is in their web development and content creation. We took a look at each of the top six’s content management systems, their homepage layouts, and key design aspects. Here are some interesting takeaways from the analysis:

- Static Website Coding: The majority of these firms use a static.NET coding language, making updating them labor intensive. The structure is probably due, at least in part, to the significant age of these domains – nearly 20 years old each. In addition, only Freshfields Bruckhaus Deringer leverages responsive design for mobile and tablet users.

- No Content Management Systems: Skadden uses Drupal framework and Baker McKenzie uses Ektron. The remaining four firms don’t have an active CMS, relying on.NET coding. Adding pages to those sites practically demands dedicated IT professionals on hand.

- Sporadic Page Headings: No firm we looked at is consistent with their page headings; content that search engines use to help them determine the main focus of websites. Freshfields Bruckhaus Deringer and Norton Rose Fulbright have a whopping 11 H1’s on their homepages, meanwhile Baker & McKenzie has no H1’s on their homepage. Skadden has no H1’s, H2’s, or H3’s. Linklaters has a single H1, which is best practice, but it’s a duplicate of their page title.

- Lacking Meta Descriptions: Freshfields Bruckhaus Deringer, Allen & Overy, and Norton Rose Fulbright have a meta description on their homepages. Only Allen & Overy uses meta keywords. Baker & McKenzie’s homepage has no H1’s, no meta description, and no meta keywords.

Meta Titles and Descriptions Expanded

Let’s take a look at their meta titles and descriptions. Metas let Google know what terms a site thinks are the most relevant, so perhaps if there is a problem with these sites ranking for terms that they should be visible for, it might start there.

You’ll notice that Freshfields and Allen & Overy have structured, intentional meta titles and descriptions. They may not be great, but at least they are deliberate. These two sites also had nicely marked up microdata and Google was pulling in their search function, site navigation, and Wikipedia information into the search results.

Skadden, Linklaters, an Baker & McKenzie are a completely different story. You’ll notice that the meta descriptions for Skadden, Linklaters, and Baker & McKenzie look like a jumbled mess of words. That is because they are. Google is pulling in text from the main page for each site into the meta description. Obviously, that is far from optimal.

Where Each Site Ranks for the Term “Law Firm”

Drum roll…..performing a search for that term in an incognito window with the location set to ‘United States’ yielded no results for any of the top six AM Law websites in the top 100 results. Let’s pull that fact out:

None of the top six largest law firms in terms of revenue showed up in the top 100 Google search results for “Law Firm”.

I fully expected at least one of the firms profiles to rank for the term ‘law firm’. The first AM Law 100 firm that came up for the search term was Orrick at 23. A search for “litigation law firm” also yielded no results in the top 100.

Do Big Firms Pay Attention to Digital Marketing?

In the sense that they track analytics and traffic data, it appears that the six firms do pay attention to digital marketing. Baker & McKenzie, the largest firm by revenue in the world, uses Unica tracking code on their site. All five of the other top six use Google Analytics to track their traffic data.

However, none of the data matters if the decision makers aren’t paying attention to it. Many of the aspects that we outlined in this article are missing or not set up correctly for at least a few of the sites. For the amount of money you would assume these firms spent developing their websites, it seems negligent that they don’t have something as simple as meta descriptions set up properly.

Despite billions in annual revenue, a business still needs to get the digital marketing basics right or Google (or any search engine) won’t reward them with prominent placement. Google wants to promote brands in its search results, not just websites. Every firm in the AM Law 100 is clearly a big brand in its own right, but is that necessarily all it takes to rank well and maintain a strong web presence? Can we conclude that Google’s focus is on strong brands and despite the unfocused backlink profiles, the brand preference is still carrying the day for these companies? The quick (incognito) Google search for ‘global law firm’ could reveal a good deal about how far these brands need to go to show up for the industries they’re famous for dominating.

In summation, it would appear that some of the firms outlined don’t seem to prioritize some of the aspects that every other website in the world uses to help them be visible in Google search. On the other hand, given the billions of dollars these massive global businesses bring in each year, perhaps some of this is intentional. Perhaps they believe they don’t need Google.